hotel tax calculator bc

Base amount is 11070. A tax rate increase will only take effect after an application has been approved by regulation.

Canadian Income Tax Calculator On Sale 52 Off Edetaria Com

Revenues from sales taxes such as the PST are expected to total 7586 billion or 225 of all.

. The BC homebuyer tax calculator application is a free service offered by the British Columbia Real Estate Association. Now multiply that decimal by the pretax cost of the room to find out how much the hotel tax will add to your bill. For example if your hotel is located in Vancouver which is subject to a 2 MRDT and a 15 destination marketing fee and you provide a room in your hotel for 200 per night your guest.

No hotel tax or levy YUKON No hotel tax or levy BEYOND CANADA NEW YORK STATE New York State legislation plus munic-ipal andor county authorizations to collect taxes on their behalf. Avalara automates lodging sales and use tax compliance for your hospitality business. Ad Finding hotel tax by state then manually filing is time consuming.

Select the appropriate tax rates for the desired service area and property class by clicking on the box to the right. GST 5 PST 7 on most goods and services. It is generally progressive because it is paid by businesses and higher.

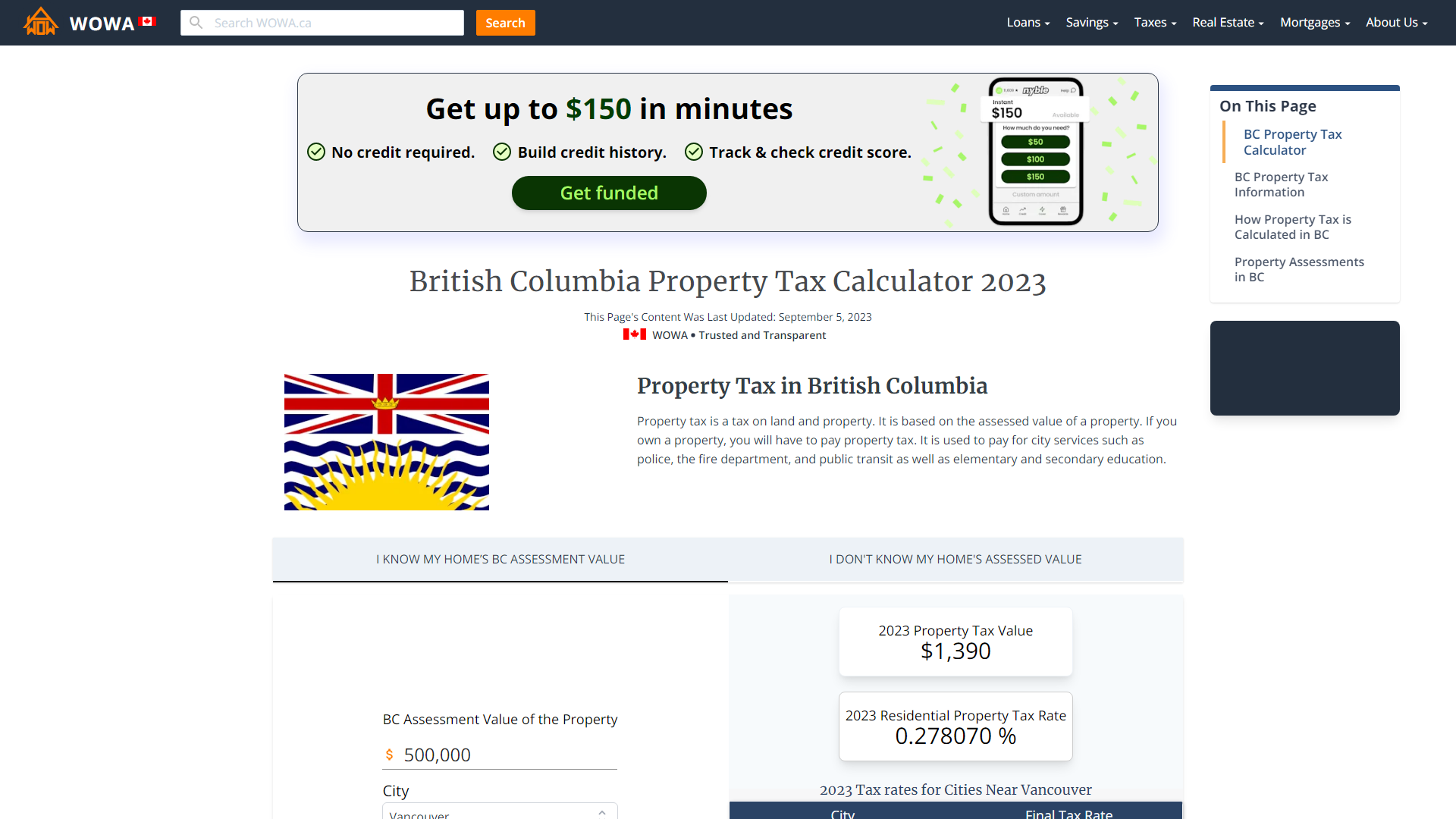

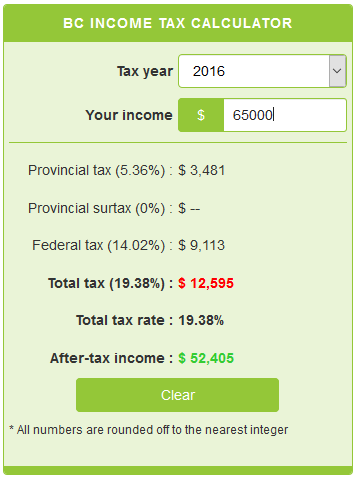

In 2021 British Columbia provincial government increased all tax brackets and base amount by 1 and tax rates are the same as previous year. Current GST and PST rate for British-Columbia in 2021. BCs Vacancy Tax can be 05 of your homes assessed value annually.

You can calculate your Annual take home pay based of your Annual gross income and the tax. Applies to major cities in BC. The British Columbia Annual Tax Calculator is updated for the 202021 tax year.

When all the rates have been selected click on any of the Calculate buttons to. Current GST and PST rate for British-Columbia in 2019. Taxable and Exempt Accommodation Definitions For the purpose of PST and.

3 on the balance. 1 on the first 200000. Only In Your State.

Use our Income tax calculator to quickly estimate your federal and provincial taxes and your 2021 income tax refund. The global sales tax for Bc is calculated from provincial sales tax PST BC rate 7 and the goods and services tax GST in Canada. Calculate your BC Vacancy Tax from your homes assessed value.

Since your employer health tax is over 292500 you are required to make quarterly instalment payments. Type of supply learn about what. Hotels in most parts of BC will be 15 5 GST 8 PST short term accommodaton only 2 MRDT formerly known as Hotel Tax.

Income Tax calculations and RRSP factoring for 202223 with historical pay figures on average earnings in. Ad Finding hotel tax by state then manually filing is time consuming. Sales taxes make up a significant portion of BCs budget.

For most residential properties the general property transfer tax calculation is as follows. The following table provides the GST and HST provincial rates since July 1 2010. The British Columbia Income Tax Salary Calculator is updated 202223 tax year.

The global sales tax for Bc is calculated from provincial sales tax PST BC rate 7 and the goods and services tax GST in Canada. So if the room costs 169 before. BC Revenues from Sales Taxes.

Hotels in most parts of BC will be 15 5 GST 8 PST short term accommodaton only 2 MRDT formerly known as Hotel Tax. A hotel and accommodation tax or levy is a specific fee on hotel or motel charges. View historical tax rates for residential utilities supportive housing major industry light industry business recreational and non-profit and farm properties PDF file 2 pages each.

2 on the balance up to and including 2000000. The information used to make the tax and exemption. Hotel Room Rates and Taxes.

2 Municipal and Regional District Tax MRDT on lodging in 45 municipalities and regional districts. 1 This regulation may be cited as the Hotel Room Tax Regulation. Hotel Room Rates and Taxes.

Avalara automates lodging sales and use tax compliance for your hospitality business. Hotel and accommodation taxes. In British Columbia an 8 Provincial Sales Tax PST is charged on all short-term room rentals by hotels motels cottages inns resorts and other roofed accommodations with four or more.

21 In this regulation unless the context otherwise requires section 1 of the Act shall apply. The rate you will charge depends on different factors see. 8 rows Income Tax Calculator British Columbia 2021.

The instalment payment due dates are.

Statistics Canada Property Taxes

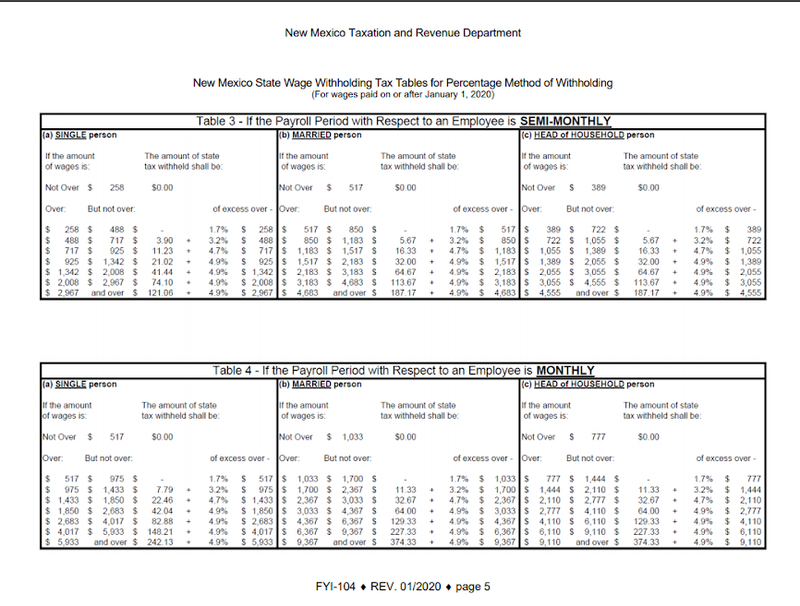

How To Calculate Payroll Taxes For Your Small Business

Ontario Sales Tax Hst Calculator 2022 Wowa Ca

Land Transfer Tax In Toronto Ratehub Ca

Use This Sales Tax Calculator To Figure Sales Tax Or Vat Gst At A Rate Of 15 Free To Download And Print Sales Tax Calculator Tax

Canadian Income Tax Calculator On Sale 52 Off Edetaria Com

Canadian Income Tax Calculator On Sale 52 Off Edetaria Com

Income Tax Calculation A Y 2021 22 New Income Tax Rates 2021 New Tax V S Old Tax A Y 2021 22 Youtube

Eligible Meal And Lodging Expenses For Truck Drivers 2022 Turbotax Canada Tips

British Columbia Gst Calculator Gstcalculator Ca

Tax Season Filing Dos And Don Ts To Keep In Mind Department Of Revenue City Of Philadelphia

Moving Expenses And Tax Deduction Move It